Getting your product pricing strategy right can make or break your business. Prices that are too high makes customers walk away. While prices that are too low, can result in you working hard but barely making money. The truth is, pricing isn’t just about covering costs, it’s about understanding numbers, reading your market, and knowing how customers think.

Whether you’re launching your first product or rethinking your current prices, this guide breaks down the essentials of markup, margin, and pricing psychology.

Understanding the Basics: Markup vs. Margin

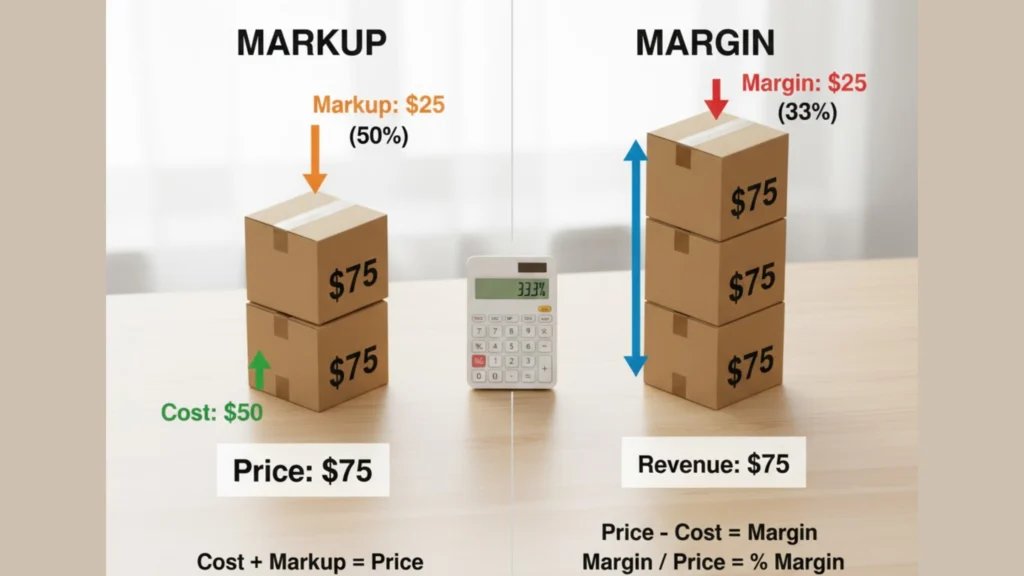

Before diving into any product pricing strategy, you need to understand two fundamental concepts that many new sellers confuse: markup and margin.

Markup is how much you add to your cost to determine your selling price. If a product costs you $50 and you want a 50% markup, you add $25, making your selling price $75.

Margin is your profit as a percentage of the selling price. Using the same example, that $25 profit on a $75 selling price gives you a 33% margin.

Here’s the key difference: markup is calculated from your cost, while margin is calculated from your selling price. A 50% markup doesn’t equal a 50% margin. This distinction matters because understanding profit margin calculation helps you see what you actually keep after each sale.

Most successful businesses aim for margins between 20-50%, depending on their industry and business model. Products with higher overhead need higher margins to stay profitable.

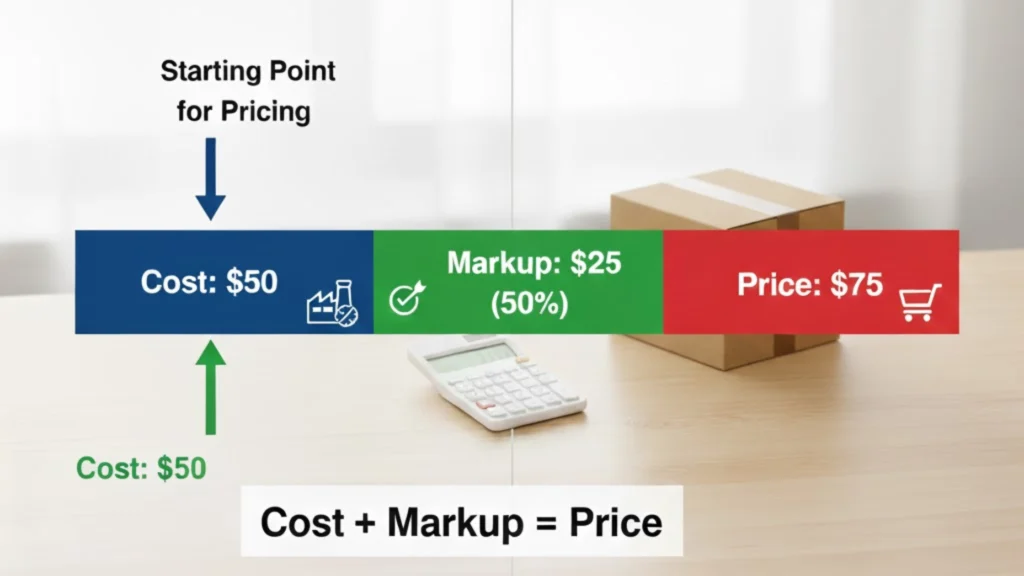

Cost-Plus Pricing: Your Starting Point

The simplest product pricing strategy is cost-plus pricing, where you calculate all your costs and add your desired profit.

Start by identifying your total costs:

- Product cost: What you pay your supplier or manufacturer

- Shipping and handling: Getting products to you and to customers

- Platform fees: Marketplace commissions or payment processing fees

- Marketing costs: Advertising, social media, content creation

- Overhead: Storage, software, packaging materials

Once you know your true cost per unit, add your target profit margin. If your total cost is $40 and you want a 40% margin, divide $40 by 0.6 (which is 1 minus 0.40) to get a selling price of $66.67.

Cost-plus pricing gives you a baseline, but it shouldn’t be your only consideration. The market doesn’t care what your costs are, customers care about value.

Competitive Pricing: Knowing Your Market

No product pricing strategy works in isolation. You need to understand what competitors charge and where you fit in the market landscape.

Research similar products in your niche. Look at direct competitors and adjacent products that solve the same customer problem. Note their price ranges, but also consider:

- Product quality differences

- Brand reputation

- Customer service levels

- Unique features or benefits

You don’t need to match competitor prices exactly. If you offer better quality, faster shipping, or superior customer support, you can charge more. If you’re building volume, you might price lower initially.

Learn more about finding profitable products in our guide on how to use Google trends + amazon best sellers to find winning products ideas.

The goal isn’t always to be the cheapest. Many successful sellers use value-based pricing, where prices reflect the perceived value customers receive rather than just competing on cost.

Psychological Product Pricing Strategy That Work

Here’s where your product pricing strategy gets interesting. Human psychology plays a massive role in purchasing decisions, and smart sellers use pricing psychology to their advantage.

Charm Pricing: Ending prices in .99 or .97 makes products feel cheaper. $29.99 feels significantly less than $30, even though it’s just a penny difference. This tactic works because we read from left to right and anchor on that first number.

Price Anchoring: Show a higher “original price” next to your sale price. This creates a reference point that makes your actual price seem like a better deal. Just ensure your original prices are legitimate to maintain trust.

Tiered Pricing: Offer three options – basic, standard, and premium. Most customers choose the middle option, which you’ve strategically priced for optimal profit. This also makes your premium option seem more reasonable.

Bundle Pricing: Selling multiple items together at a slight discount increases average order value while making customers feel they’re getting more value.

Prestige Pricing: For luxury or premium products, round numbers ($100 instead of $99.99) can signal quality and sophistication.

These psychological pricing tactics work, but they must align with your brand and customer expectations. A discount brand using prestige pricing will confuse customers, while a luxury brand using charm pricing might cheapen its image.

Testing and Adjusting Your Prices

The best product pricing strategy involves continuous testing and refinement. Your first price is an educated guess, real market feedback shows you what actually works.

Start with A/B testing if you have the traffic. Show different prices to different customer segments and measure conversion rates. Sometimes a small price increase has minimal impact on sales but significantly boosts profit.

Monitor these key metrics:

- Conversion rate: What percentage of visitors buy?

- Average order value: How much do customers spend per transaction?

- Profit per sale: After all costs, what do you actually make?

- Customer lifetime value: Do pricing changes affect repeat purchases?

If sales are strong but profits are thin, you’re likely underpriced. If traffic is high but conversions are low, you might be overpriced, or you have a value communication problem.

At Shopinbos, we help new eCommerce sellers navigate these pricing decisions with practical guides to ensure you’re making informed pricing choices regardless of where you sell. Not sure what to charge? Find your perfect price with our easy-to-use pricing calculator.

Avoiding Common Pricing Mistakes

Even experienced sellers make pricing errors that hurt profitability. Avoid these common traps:

Forgetting hidden costs: Many sellers only consider product cost and shipping, forgetting returns, customer service time, and failed marketing experiments. Track everything.

Racing to the bottom: Competing solely on price is exhausting and rarely sustainable. Focus on value, not being the cheapest.

Set it and forget it: Markets change. Review your product pricing strategy quarterly at minimum, adjusting for cost changes, competitive shifts, and demand patterns.

Ignoring perceived value: If customers see tremendous value in your product, you’re leaving money on the table by pricing too low. Premium pricing can actually increase perceived quality.

Overcomplicating things: Your pricing should be easy to understand. Confusing pricing structures create friction and reduce conversions.

Frequently Asked Questions

What’s the ideal profit margin for ecommerce products?

Most successful ecommerce businesses aim for 25-40% profit margins after all expenses. However, this varies by industry, business model, and growth stage. High-ticket items might work on lower margins while building volume, whereas niche products with less competition can support 50%+ margins. Calculate your break-even point first, then add margin that supports sustainable growth and reinvestment.

How often should I adjust my product prices?

Review prices quarterly as a standard practice, but adjust immediately when major cost changes occur. Monitor competitor pricing monthly and watch for market shifts. Seasonal products may need price adjustments several times per year. Avoid changing prices too frequently though, constant fluctuations weaken customer trust and make your brand seem unstable.

Should I offer discounts to increase sales?

Discounts can boost short-term sales and clear inventory, but use them strategically. Frequent discounts train customers to wait for sales rather than buying at full price, which damages long-term profitability. Instead, focus on creating genuine value, building scarcity, or offering bundles that increase average order value without devaluing your core pricing.

How do I price products when I’m just starting out?

Start with cost-plus pricing to ensure profitability, then research competitor pricing to position yourself appropriately. Begin with conservative margins that allow flexibility, it’s easier to increase prices than lower them. Test different price points with small inventory batches before committing to large orders. As you gather customer feedback and understand perceived value, adjust your pricing strategy accordingly.